Like any American, undocumented immigrants must pay taxes before the Internal Revenue Office (IRS), which is beneficial in several aspects, including some possible immigration process for their protection in the event of changes in the law or if they can apply for a ‘green card’ at some point.

Even these workers can receive refunds from the IRS if they qualify for it once they report the income they had in the corresponding year, filing the return with your Personal Taxpayer Identification Number (ITIN).

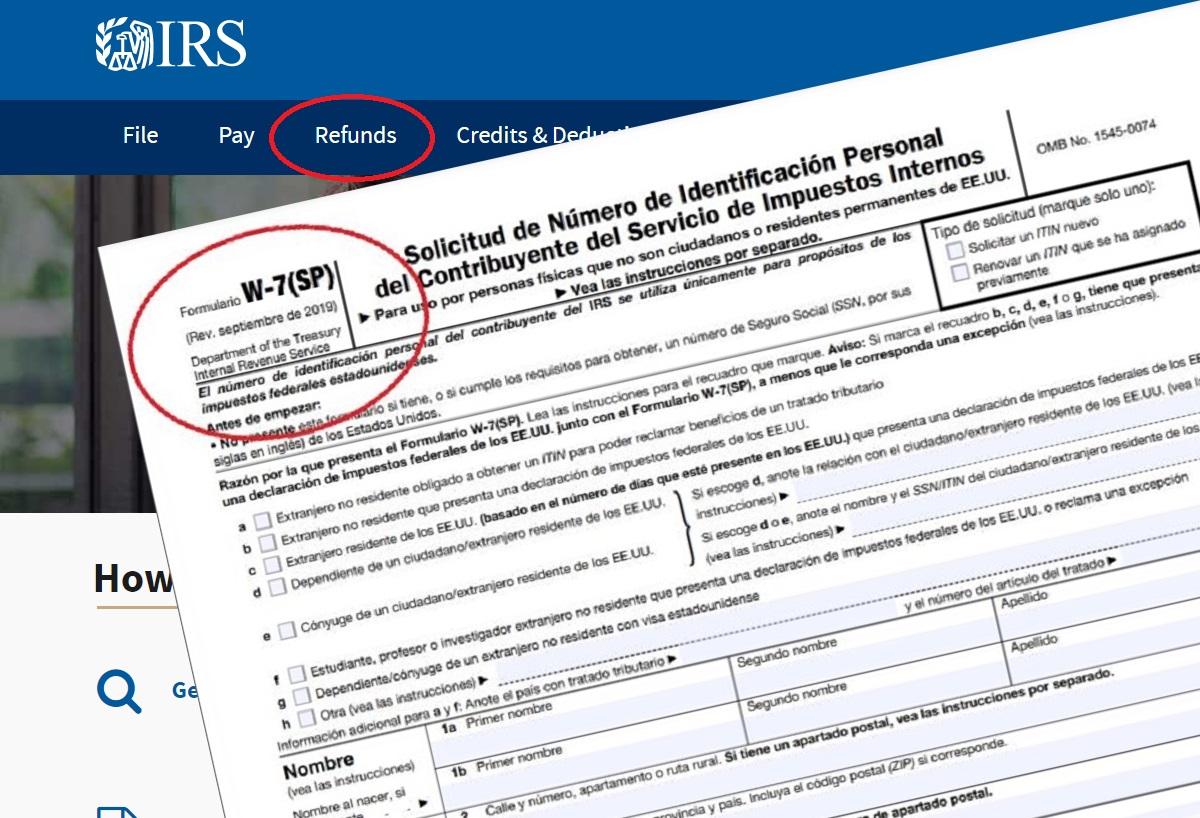

Remember that if you do not have that number, you can request it with form W-7 at the IRS.

On reimbursement, experts say that some people may receive them, but others may not qualify for it Well, it depends on each case.

Lawyer Alex Gálvez, who practices in Los Angeles, California, explained to Univision that immigrants who prove that they received a salary and had enough taxes deducted for a year, also taking into consideration their dependents , then they would have some refund.

“You do qualify for a tax refund”, he said.

Although attorney José Guerrero, from Miami, Florida, emphasized that undocumented immigrants who file their taxes do not always get a refund.

“It all depends on how you generated the income and if you have how to prove it. This is the only way to establish whether or not you qualify for a refund from the IRS”, he recalled.

Experts suggest that undocumented immigrants seek advice from a county attorney or a lawyer to help them determine their case, both the income report and possible reimbursements.

However, it is important to remember that undocumented immigrants must pay their taxes, since failure to do so could complicate their immigration processes, even if it is a provisional protection from deportation.

Guerrero and Gálvez said that a benefit that immigrants may not receive when reporting taxes is about benefits for contributions, that is, from the Social Security Administration (SSA).