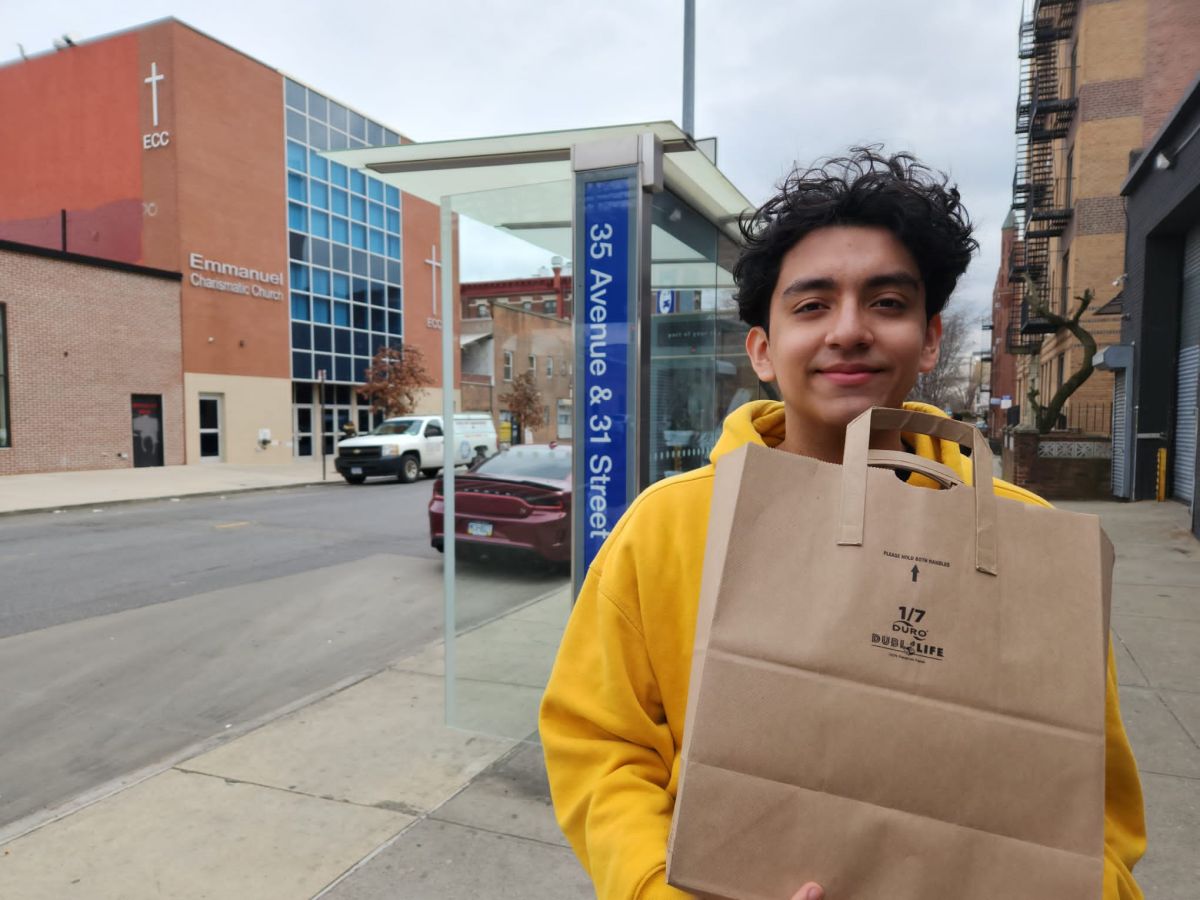

José Fernández already has the suit ready that in a few weeks he will wear at the high school graduation party, which his parents are organizing for him, in his humble house in Corona, Queens. But in the midst of the emotion that he is about to receive what will be the first high school diploma that will be hanging in the living room of the apartment, the young Mexican confesses that a concern assails him: the university… how to pay for the university.

At barely 17 years old, the immigrant, who arrived in New York in 2017, reveals that his greatest wish is to become a lawyer, to defend his community and give his parents and two younger brothers a better life, but at the same time At the same time, he admits that he does not have the resources to take that step, and that in the attempts he made to receive financial aid from credit corporations or educational institutions, refusals were the order of the day.

“As a child, the weight of not having papers is not felt very much, but when we get older and we reach this moment in which we have to walk on our own, the issue of being an immigrant feels strong, and even more so being poor and perhaps having to give up dreams of studying,” says the New Yorker, one of the thousands of students who will graduate from high school in the city this year. In 2022, a total of 59,374 youngsters completed their high school studies in the five boroughs.

“We need financial help. And help is not that they lend us to get into debt for the rest of our lives, no. Help is that they expand study programs, scholarships or create plans to return what they invest in us with what we learn, being useful in our communities”, adds the native of Guerrero, in Mexico. “I don’t want to pay a debt for the rest of my life, while earning low wages as a professional.”

Lucas Páez, 19, who graduated two years ago, and who attends a “community college” where he is “polishing his English,” also expresses the same concerns. He wants to be a psychologist, but with his parents’ full-time jobs that earn minimum wage and only a few years living in the country, he feels there isn’t enough help for high school graduates like him.

“Sometimes I don’t understand how this City doesn’t invest in youth. They talk about the fight for equality and equity, and what about us? Going to university is very expensive in this city, and it scares me to think of taking out a loan and having a debt of half a million dollars at 23 years old,” says the Colombian, who wants to study at Columbia, and asks the local government to Create more scholarships and grants to fund higher education for low-income students.

Natasha Capers, director of the Coalition for Educational Justice, warns that coming out of high school, one of the biggest challenges facing many students, especially minorities, is getting into college, since they don’t count with the necessary support or resources.

“Many New York public school students face some difficult challenges after graduating high school and going to college, especially if they haven’t received the support they need to do well,” warned the activist, who noted that another of the The problems that young people face is the lack of support in their schools in mentoring and counseling that help them reach higher education. “Most of our high schools don’t have counselors or college advisers. The process of going to college, doing well, and graduating is difficult enough, but adding additional layers of lack of support and assistance will require financial aid and all too often creates a huge barrier for students. color”.

And given the headache that the debts they contract to pay their tuition have meant for many New Yorkers who arrive at the university, precisely a few days ago the federal Department of Education announced the forgiveness of their payment obligations for almost 49,000 debtors of student loans in new york

The forgiveness of his debts, which are equivalent to more than $3.100 million dollars, were for professionals who work in public service work. Nationwide, it benefits 616,000 people, such as teachers, firefighters, and members of the public order forces, among others.

“While hundreds of thousands of New York borrowers have already benefited, more will benefit as the program continues,” the federal agency added. “Since day one, the Biden-Harris Administration has worked tirelessly to fix a broken student loan system, including making sure to honor the promise of public service loan forgiveness for those who have spent a decade or more serving our families. communities and our country,” said US Secretary of Education Miguel Cardona.

“To date, the Biden-Harris team has delivered on that promise for more than 615,000 teachers, nurses, social workers, service members and other public servants by approving a combined $42 billion in student loan debt forgiveness… this reminds us why we must continue to do everything we can to fight for borrowers and why families cannot afford to have partisan politicians derail their progress.”

And in order for more New York students who finish high school to access higher education, the national Department of Education assured that they “are continually working to make the Free Application for Federal Student Aid (FAFSA) form more accessible to students. and parents applying for grants, loans, and work-study funds for education after high school.”

They also stated that this year they have been “redesigning, simplifying and optimizing” the FAFSA 2024-25 form, “an action that they described as the most ambitious and significant in the application for and delivery of federal student aid in decades.

“The changes will provide a more streamlined application process, expanded eligibility for federal financial aid, reduced barriers for certain student populations, and an improved user experience for the FAFSA form,” they added, explaining that for undocumented parents, the FAFSA form 2024-25 will be easier to complete because they can get a username and password (known as an FSA ID) without a Social Security number, to electronically complete their portion of their child’s FAFSA form.

The Department of Municipal Education (DOE) ensures that public schools in the Big Apple offer year-round training for school personnel who support students with post-secondary planning, specifically financial planning for college. While adding that they ensure that the FAFSA guides are translated into all DOE priority languages.

“Providing students with multiple pathways to reach their goals is the cornerstone of any effective school system. In New York City Public Schools, we work with staff and students throughout the year to connect them with resources that will help inform their post-secondary plans,” said Chyann Tull, spokesperson for the Department of Public Schools. .

Another of the existing options that New York graduate students have to make their dream come true are the programs at the City University of New York (CUNY), where Latinos represent 29% of the total student population.

“The University has the top 5 universities in the state of New York, where Latinos obtain degrees or certificates. CUNY also ranks in the Top 5 in the state in terms of Hispanic enrollment,” a CUNY spokesperson said, adding that 7 CUNY schools have at least 45% of their student population Hispanic.

And in terms of financial aid, CUNY notes that thanks to the federal and state aid they receive (TAP, and the Excelsior Scholarship), 68% of undergraduate students in the State attend without paying tuition and 75% graduate. no debts. They also warned that there is financial aid for undocumented students.

“CUNY’s affordability is unrivaled in New York and we are proud to offer tens of thousands of students each year the opportunity to earn a degree without debt. Before any financial aid, the annual tuition for our community colleges is $4,800 and for colleges it is $6,930,” the institution warns.

And to reach out to recent graduates and prevent the lack of financial resources from being an obstacle to advancing towards their higher education, from another front, the City Council is promoting the approval of $388.1 million in its budget for the next fiscal year. to adequately finance educational priorities.

They also include $4.8 million for the Inclusive Economy program, which aims to increase the percentage of CUNY students connecting to career paths, “providing city businesses with an educated and talented workforce, $2 million for Gateway Course Success Initiative (formerly CUNY Remediation), which has phased out outdated traditional English and math remedial courses that thousands of students in associate programs had taken for decades, replacing them with more equitable “corequisite” courses, and $1 million to the Institute CUNY STEM which offers courses in physical sciences, mathematics, English, engineering, programming, entrepreneurship and other enriching fields.

Data to take into account

- 59,374 students graduated from high school in NYC in 2022

- 49,000 New York student debtors received loan forgiveness

- $3.100 million dollars is the value that the federal government is forgiving in debts in NY

- The federal FAFSA form, help resources, and other information can be found at fafsa.gov.

- Undocumented students, including Deferred Action for Childhood Arrivals (DACA) students, are not eligible for federal student aid. However, they may be eligible for state or college financial aid, in addition to private scholarships. look at this link

- Parents’ citizenship status does not affect a student’s eligibility for federal student aid

- Information on how to apply to CUNY colleges and programs can be found here

- 29% of CUNY students are Latino

- 68% of undergraduate students d the State attend tuition-free

- 75% graduate debt free