It’s hard to find a small business in the South Bronx where the owners don’t make it clear that they are having a hard time keeping their business going.

“I do not know what’s happening. In my hairdresser we are all seeing each other’s faces. There are almost no customers and that is what happens to most of my business colleagues, who have been here for years. After the pandemic, we have not been able to recover. Hardly struggling for rent”, comments the Dominican Josefina Colón, one of the hundreds of immigrants who is crossing through the “arid desert” to try to maintain her business operation.

Josefina says that even this summer, people “didn’t turn out” as expected. She interprets that the clients are barely moving for the basics: food and medicine.

Certain tastes, such as eating out and having a few hair touches, apparently are a “super luxury” for many families, the merchant points out.

The worker at a warehouse on Grand Coucourse Avenue and 138th Street, while receiving merchandise, shouts that criminals do not stop constantly “visiting” the business demanding that they give him cigars or beers.

“People don’t stop coming to their wineries. But unfortunately the thieves do not stop bothering, ”he specified.

Consulted restaurant owners assure that in many cases, they continue to pay bills accumulated during the pandemic.

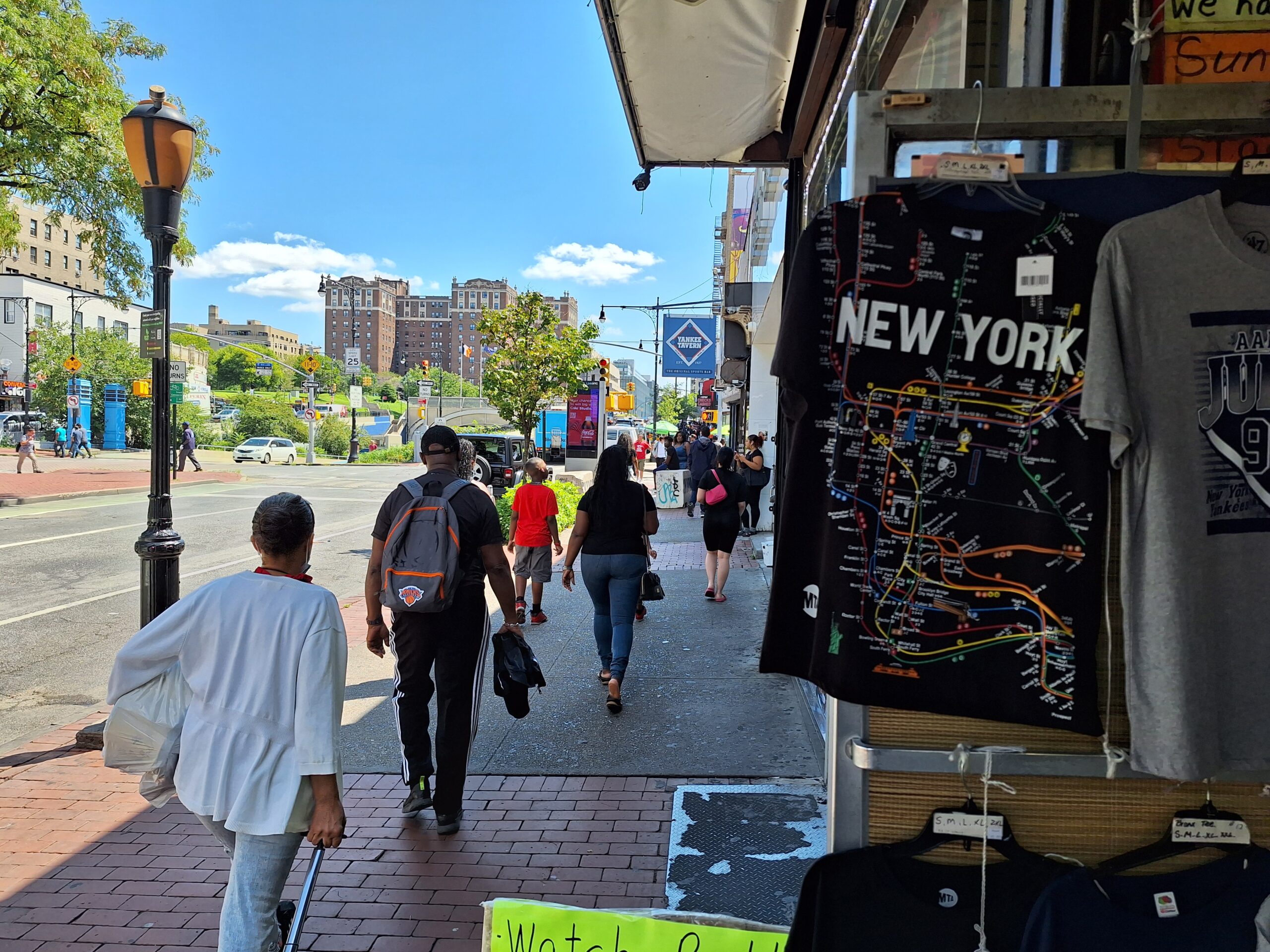

In the surroundings of Yankee Stadium the trend is different, because before and after each game, hundreds of fans and tourists usually “flood” the businesses.

But out of season, “loneliness” is the hallmark of business activities for a sector of the economy, which despite the end of pandemic restrictions, shows no real signs of recovery.

A relief for the South Bronx

Amid this climate of business devastation, the NY Empowerment Zones Corporation has approved a $10,000,000 loan program for salsa county businesses, to be administered by the Bronx Economic Development Corporation (BxEDC) in partnership with The Business Initiative Corporation of New York (BICNY).

Empowerment Zones were created in the 1990s, under President Bill Clinton, providing tax breaks and other incentives for growth in economically depressed areas.

This new financing will provide working capital for small and medium-sized businesses looking to expand their operations.

Loans will range from $5,000 to $350,000 and can be used to cover costs such as payroll, inventory purchases, or new equipment.

The program focuses on making loans to businesses located in the South Bronx and, in particular, in the Empowerment Zone district, including the Hunts Point, Port Morris and Yankee Stadium neighborhoods.

Loans will be made through the Small Business Administration’s (SBA) Community Advantage Loan Fund.

“This announcement that will bring $10 million in Empowerment Zone funding is a huge win for The Bronx and fulfills one of our key promises from our State of this County address to support and enhance our small business community,” Vanessa explained. Gibson, President of this County.

The loan program will be primarily for communities within the Empowerment Zone or considered Low to Moderate Income (LMI). Startups, that is, initiatives that are just getting started, can also apply.

Loan maturity is 10 years with competitive and flexible interest rates that can range from 2.5% to 6%.

“Small businesses are the heart of our neighborhoods and the backbone of our economy, creating jobs and expanding opportunity for residents. I encourage all small business owners to apply to take advantage of this tremendous opportunity! said Congressman Ritchie Torres.

To cover debts

For his part, Francisco Marte, founder of the Association of Small Businesses and Warehouses of NY values as positive any effort that arises to offer economic aid to a sector of the economy, which in his opinion, is “having a bad time.”

“Let us be clear that the majority of our union members are struggling with debts. For example, I have grocers who urgently need help to cover exorbitant electricity bills. Now in the summer, in a small store, the merchant can receive bills of $4,000. I insist any help or incentive for this guild will be well received. But it must be understood that what there are are large debts”, highlighted the Dominican.

According to data updated until last June, The Bronx has one of the highest unemployment rates in the state of New York, with an average of 7.6% unemployment, when the state rate is 4.2%.

This historic trend of economic hardship for business entrepreneurs, in one of the poorest counties in the country, in the words of some residents, shows no signs of recovery in the future.

“Here the only thing we have seen again lately is more people selling drugs on the streets and small businesses closing. No one will ever be able to explain to us how, with New Yorkers with so much poverty and need here, the food and lodging bills of thousands of new arrivals continue to be paid,” concluded Puerto Rican Lizandra Camil, who has lived in the vicinity of Yankee Stadium for 50 years.

Lizandra had to close her food business during the pandemic and was never able to open it again.

“They’re giving $10 million in interest-bearing loans to job creators and taxpayers in the Bronx. That’s the same as they spend a day on the migration crisis,” she opined.

Loan Details

- To have precise information on how and where to apply for this credit, visit the web portal: https://www.bicofny.org/loans

- Which businesses are eligible?: All for-profit businesses, including wholly-owned partnerships, LLCs, and qualified start-ups. Special consideration will be given to businesses in the Bronx Empowerment Zone and adjacent areas.