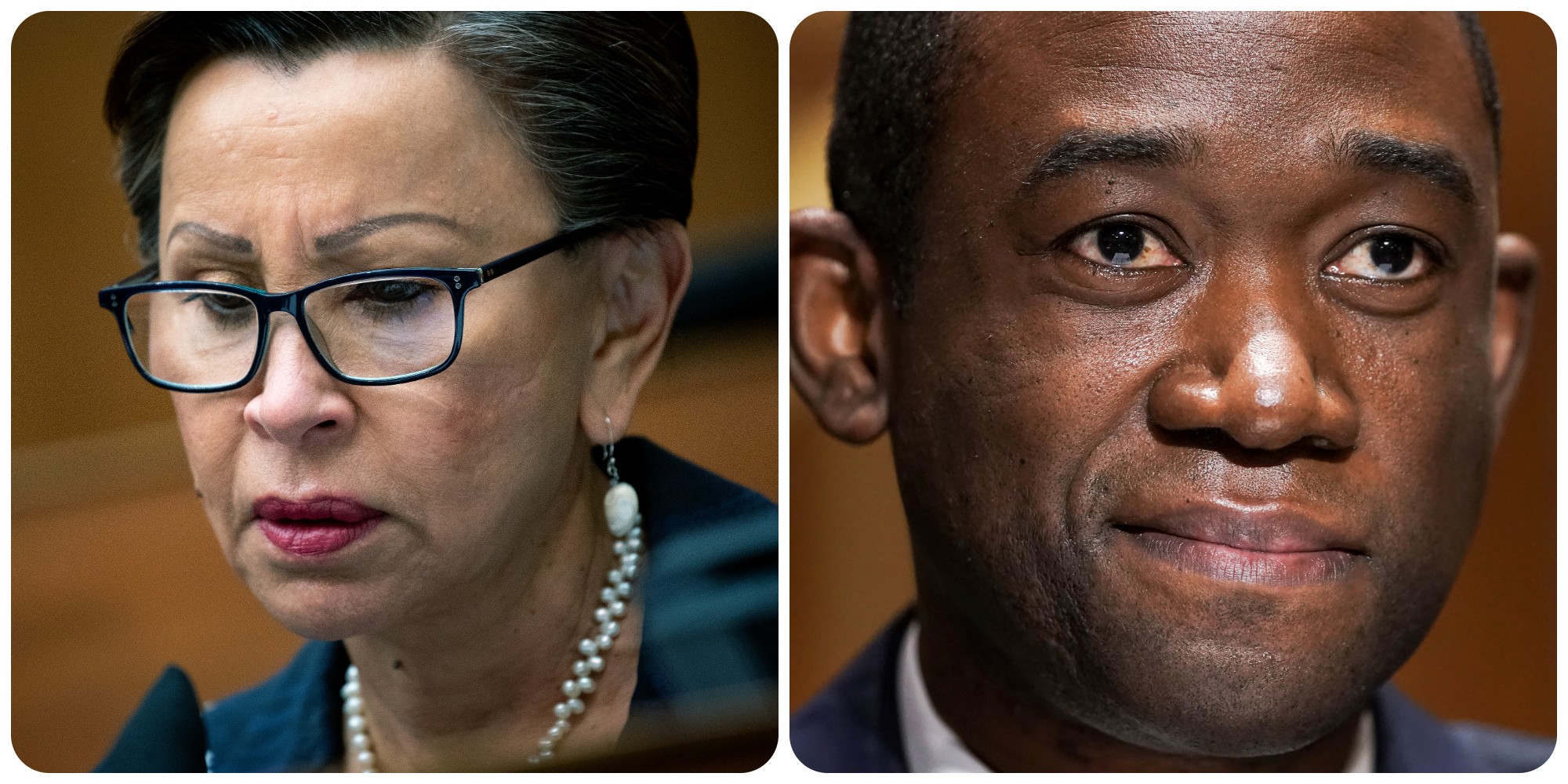

New York – New York Democratic Representative Nydia Velázquez told El Diario that she hopes to meet again with the Undersecretary of the Treasury Department, Wally Adeyemo, to continue to examine the investigation into possible federal tax evaders protected under Law 22 or the “Law to Encourage the Transfer of Individual Investors to Puerto Rico.”

This week, Velázquez and other leaders of the Progressive Caucus had a meeting with the official in which the legislator clearly stated that it is time to reveal some kind of information about the audits led by the IRS for tax evasion by beneficiaries of the aforementioned law on the island.

“What I can tell you is that we are still in the dark about the number of actions that the IRS has taken in relation to individuals who are using Act 22. Yesterday (September 10), for example, the Undersecretary of the Treasury…had a meeting with the Progressive Caucus, in which I was present, and I was clear, I told him that Congress and the public want to see results,” revealed Velázquez in an exclusive interview with this newspaper.

Velázquez said that the intention is to have another meeting with Adeyemo in the near future, which could also be attended by IRS Commissioner Danny Werfel.

“We have to continue to follow up with the agency. The Undersecretary of the Treasury agreed, and Alexandria Ocasio Cortez was with me, to hold a meeting with the IRS commissioner in which both I and AOC could participate,” he said.

What is the IRS investigating regarding Act 22 beneficiaries in Puerto Rico?

For about three years, the IRS, at the request of Congress, has been investigating about 100 recipients of Act 22, which grants tax exemptions to Americans and other foreigners who relocate to the island under the promise of investment, for failing to pay taxes at the federal level.

Specifically, the office is investigating whether these individuals lied about their stay on the island to avoid paying U.S. taxes on U.S.-sourced income.

For the Puerto Rican congresswoman, the argument that the issue is being addressed is no longer sufficient, given that the problem has reached the fiscal coffers of the United States.

Velázquez described the situation triggered by Law 22 as a “huge scam” on and off the island.

“Three years after the campaign began, it is not enough to say ‘we are working on it,’ I told him that; and that they have the resources, because through the Inflation Reduction Act (IRA), $80 billion dollars were allocated to the IRS. In other words, it is not a lack of resources, but something is happening that I cannot put my finger on; but I repeated to him that this is not only about the Puerto Ricans who are being displaced, it is about the great scam that the beneficiaries of Law 22 have done to the Americans, because they take advantage of Law 22, move to Puerto Rico, do not pay federal taxes and do not contribute to the treasury of the people of PR,” said the Democrat who represents District 7 of New York.

“It is estimated that each year, some $10 billion in federal revenue is classified as Puerto Rico revenue using Act 22. Those $10 billion should be used to provide and strengthen public education, plus funds for the U.S. health system. It is totally unacceptable,” he added.

The Democrats’ most recent conversations came after the New York Times reported last May that the IRS investigation into tax evasion against some beneficiaries of Act 22 in Puerto Rico had resulted in only 1% of foreigners being audited.

A person with knowledge of the investigation sent a letter to the U.S. Senate, prompting a formal investigation by the Senate’s Finance Committee, the paper reported at the time.

Last June, Oregon Senator Ron Wyden’s office confirmed to El Diario that, at the end of that month, the Finance Committee headed by the Democrat would hold a private briefing to discuss the matter with IRS personnel.

This newspaper contacted Wyden staff again to inquire about the results of the meeting, but did not receive a response.

According to a report by the Center for Investigative Journalism in Puerto Rico (CPI), the Department of Economic Development of Puerto Rico (DDEC), the agency that grants decrees under Law 22 in PR and is supposed to oversee them, has never revoked one of these agreements for failure to comply with the Puerto Rico residency requirement.

To comply with Law 22, beneficiaries must establish residence on the island and remain there for at least 183 days a year.

Since 2021, the DDEC has initiated some 311 processes to try to revoke decrees under Law 22 for non-compliance. Most of the actions have been because the beneficiaries did not submit their annual reports.

Under the statute, earnings from stocks, bonds or other personal property of an American are considered Puerto Rican-sourced income and are therefore exempt from taxes.

Act 22, as amended in 2012 and part of the Incentives Code (Act 60), grants tax exemptions with respect to income from investments earned by individuals who become residents of Puerto Rico, no later than the year ending December 31, 2035.

Law 22 must be repealed at the local level

Velázquez considered that the solution to the problems of Law 22 lies in its repeal at the local level where it was approved.

“Correct, or they should have the mechanisms or barriers for those tax evaders; when they say that they are moving and are going to create so many jobs, and that they are going to make so many investments in PR, they should not say it just out loud,” he said.

Velázquez has been one of the most vocal politicians on this issue in the House of Representatives and in Congress in general.

Last year, he led a letter to the IRS on behalf of organizations on the island asking the office to expedite the release of the results of the investigation.

The letter, signed by 11 other Democratic representatives, was sent to the IRS after the Center for Popular Democracy (CPD) and supporters of the “Not Your Tax Haven” (PR No Se Vende) campaign submitted a request under the “Freedom of Information Act” (FOIA) in order to gather information about the audits.

“The tax haven created by Act 22 in Puerto Rico has proliferated the use of short-term rentals (“STRs”), increased cash property sales and speculation in the market, and caused displacement of local residents in Puerto Rico,” the legislators stated in the letter to the IRS.

“Therefore, we believe it is essential to understand the extent to which the IRS and the Department of the Treasury in Puerto Rico are monitoring U.S. individuals and businesses claiming tax benefits under Act 60, particularly as the number of Act 22/Act 60 beneficiaries continues to grow exponentially,” the Democrats added.

The document also notes that Puerto Rico’s government analysis estimates that the island would lose an estimated $4.5 billion in revenue related to Act 22 between 2020 and 2026.

It was not until late March of this year that the IRS responded to both organizations and lawmakers about the progress of the investigation.

However, the data provided did not even include basic information to understand the progress of the IRS’s efforts.

The tax collection agency basically decided not to release information about the investigation.

“We searched and located 3,306 pages in response to your request. Of the 3,306 pages located in response to your request, we are attaching 0 pages. We are holding all 3,306 pages,” the agency responded.

Continue reading:

Interview with Nydia Velázquez: Puerto Ricans can “change the balance of power” in these elections

Interview: Nydia Velázquez blames Republicans for blocking discussion of Puerto Rico’s status in Congress

CPD and “PR No Se Vende” will appeal IRS decision not to disclose information on tax evasion investigation of beneficiaries of Law 22

Puerto Rico: DDEC confirms supply of information to IRS for investigation of foreigners with decrees under Law 22

“Losing Puerto Rico” launches new video to denounce displacement of Puerto Ricans by millionaire investors under Law 22